|

Register

|

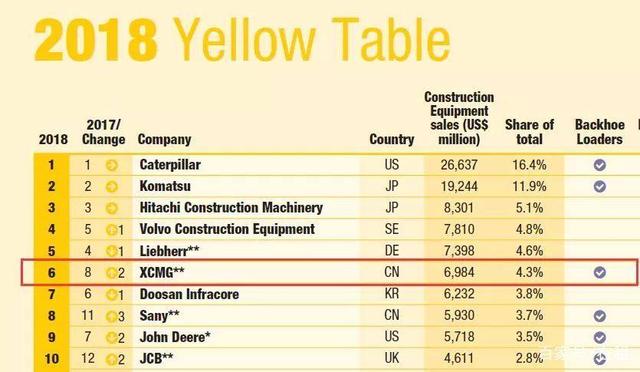

The Yellow Table, a yearly list exclusively published by International Construction magazine, has revealed that in 2017 the combined equipment sales of the top 50 equipment manufacturers was US$162 billion, an increase of 21% on 2016’s figure.

The top five companies on the list remain the same, the only difference being that Volvo and Liebherr swap places with the former climbing a place and the latter dropping down one to number five on the list. In 2017 the construction sales of the world’s top five manufacturers combined equaled $69.3 billion

Data revealed by Off-Highway Research showed the extent to which the global market has recovered regarding equipment sales in 2017. One of the key drivers of this growth was China where equipment sales increased 82%, taking units sold to above 200,000 units for the first since 2014.

With this data in mind, it is no surprise that Chinese companies have experienced the most growth on the table this year. XCMG have risen two places, from eight to sixth and Sany Heavy Industries jumped three spots from 11th to eighth.

In terms of market share, US firms are still the leaders but by a margin which is now looking increasingly slight.

US firms accounted for a 26.3% share of the revenues generated by the top 50 which is a decline from last year and not too far ahead of Japanese companies at 24.8%. The biggest mover in this field was Chinese companies, who saw their revenue share increase from 11.4% to 14%.